Trended Credit Data

Trended Data Requirement

*DU Version 10.0 has been rescheduled for release on September 24, 2016 . Click HERE for more information from Fannie Mae. Check back here for more information as it becomes available*

Beginning September 24, 2016 Fannie Mae’s underwriting process will require trended credit data. Trended data is a detailed record of a consumer’s credit history. It includes the historical payment amount for each month going back 30 months under Transunion’s CreditVision or 24 months under Equifax Dimensions. Experian’s trended credit data is expected to be added at a later date, possibly beginning in January 2017.

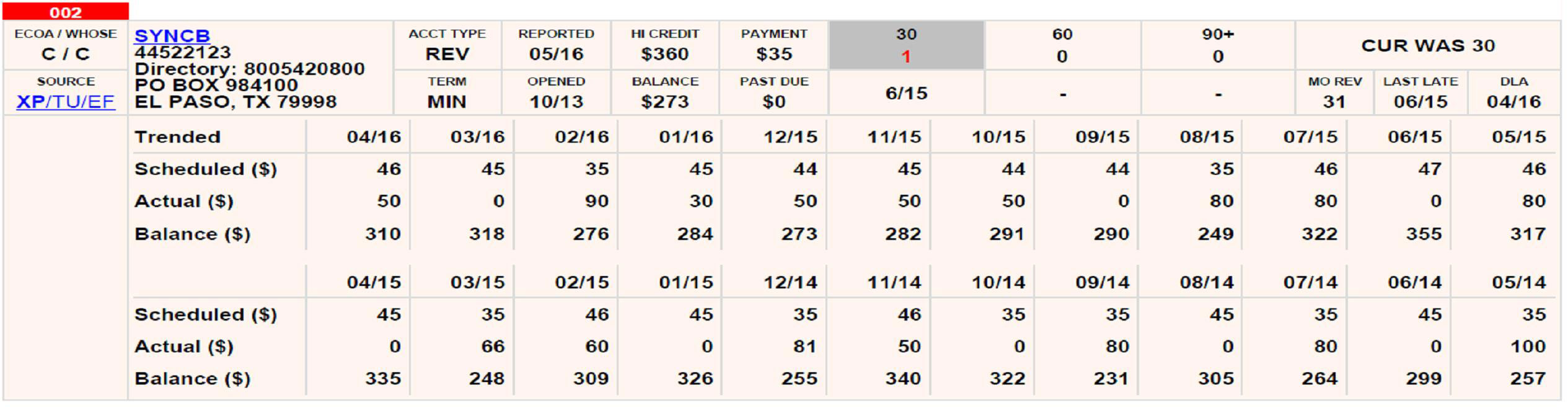

Since the credit scores currently offered by FICO® and VantageScore do not consider trended credit data, it’s unsure how trended data will impact underwriting. Below is an example of a tradeline including trended data. Note: this is a default format – any customized format you currently use will be maintained resulting in very little change to the appearance of your credit reports:

Click Here to see a full tri-merge credit report with trended data

Quickly understand the key trends happening with your applicant’s credit with TrendScape™

TrendScape also forecasts if/and when there could be a FICO score change which might affect your applicants’ current loan program qualification. Turn the new trended data into useful information with features like:

- A mid-score forecast that matters

- A concise description of the balance trend

- Knowledge of how they pay

Click Here to see an example of TrendScape

For more information, see the following resources:

- Trended Credit Data Improves DU Risk Assessment and Supports Access to Mortgage Credit – A commentary by Fannie Mae’s VP Credit Risk Analytics and Modeling, Eric Rosenblatt. Provides background on how and why Trended Credit Data is expected to assist lenders and creditworthy borrowers.

- Trended Credit Data and Desktop Underwriter® (DU®) – A one-page infographic from Fannie Mae on Trended Credit Data and DU®. Good training resource for lenders.

- Desktop Originator/Desktop Underwriter Release Notes DU Version 10.0 – Published by Fannie Mae on February 23, 21016

- Desktop Originator/Desktop Underwriter 10.0 Overview – A short presentation from Fannie Mae on what to expect, including details on Trended Credit Data

- DU Version 10.0 FAQ – Frequently Asked Questions about DU Version 10.0 being released on June 25, 2016

- Equifax: Using Trended Data to Better Understand Customer Behaviors – Trended Credit Data product information from Equifax

- Transunion: Trended Data to Support Fannie Mae Mortgage Initiative – Press release from October 19, 2015 announcing Fannie Mae plans to adopt Trended Credit Data standard.

- Transunion Creditvision Study – A video presentation from Transunion’s Chris Cartwright, President U.S. Information Services, where he reveals very compelling study results on the power of using Trended Credit Data in the mortgage industry.

- Washington Post Article – This Washington Post article summarizes Trended Credit Data in a piece called “When Seeking a Mortgage You Don’t Want to be Categorized as a Revolver.”

Frequently Asked Questions

Trended credit data provides an expanded, more granular view of the consumer by leveraging up to 30 months of a consumer’s past balance, payment, and credit utilization history. It provides a fuller picture of a consumer’s credit behavior, supplementing the traditional moment-in-time credit snapshot with a more dynamic 2-year picture of a consumer’s history of managing revolving accounts. With this additional historical data (such as payment and balance,) lenders may be able to see how consumers have managed their credit accounts over time, allowing them to better predict future behavior and assess risk. For example, a consumer with a large credit card balance who pays in full every month (a “transactor”) likely has a higher level of creditworthiness than a consumer with a large credit card balance who only makes the minimum required payment (a “revolver”). Existing credit reports can’t always differentiate between these two types of consumers.

At this time, Freddie Mac (Loan Prospector) will not be using trended credit data for decision making. Freddie Mac will not receive the new trended data elements in machine-readable formats; however, they will receive the new tri-merge human-readable print images embedded within the machine-readable formats.

No. The process of ordering credit reports will not change. Requests will continue to be processed without change through your LOS, GSE UI, directly through the Advantage Credit website.

This new standard in mortgage credit reporting officially begins with the release of DU 10.0 previously scheduled for June 25th, 2016, however Fannie Mae has pushed the date back and will announce the specific date soon. Fannie Mae states that only tri-merge reports containing trended data will be able to be reissued through DU 10.0. Therefore, lenders should plan on submitting all non-trended credit reports prior to the release of DU 10.0, (date TBD). Note that Advantage Credit began delivering trended data credit files to its mortgage lending customers during the live “test period” which started on March 22nd, 2016.

By default, tradelines that include trended data will not display in the client’s report layout. Rather, the trended data will be available for viewing through the user interface by clicking into the individual bureau data sets within the credit report. We are anticipating that lenders will not want to see the trended data in the print image due to the potential for much larger file sizes. However, Advantage Credit will be able to accommodate clients who may have different report layout preferences with respect to trended data. Note: We have verified with Fannie Mae that they dot require the trended data to be displayed on the lender’s credit report as long as it is viewable within the raw data.

While trended credit data will be included as part of the Fannie Mae loan review with the DU 10.0 release (date TBD), Fannie Mae hasn’t released guidelines as to how trended data will be scored or impact the underwriting process. Neither FICO nor VantageScores incorporate trended data into their scoring system. For additional information please refer to Fannie Mae’s 10.0 Preview release notes.

TransUnion and Equifax are the only repositories providing trended data in the beginning of the rollout. Experian may be included at a later date.

The appearance of your credit report will change very little. Trended data on each qualifying tradeline can be viewed by the lender by clicking into that tradeline’s bureau data set. It is possible to display the trended data in the body of the report, however, we believe doing so may unnecessarily add many pages to your credit report. That said, it is possible to display trended data in the body of the report while maintaining all current report layout/formats. Note: We have verified with Fannie Mae that they don’t require the trended data to be displayed on the lender’s credit report as long as it is easily viewed in the raw data.

Not all tradelines qualify. Trended Credit Data may not be present when the account type is :

- Authorized User Child/Family Support Collections

- Duplicate trade

- Insufficient Information to Score: File contains no trade, inquiry, collection or public record.

- Less than 6 months of history in an Open status.

- Lost/Stolen

- Masked trade data for certain narrative codes (bankruptcy, in dispute, medical, repossession, foreclosure, etc.)

- Months since reported > 24

- Public Records

- Subject Deceased

- System Reject – Model Delivery is Temporarily Unavailable

Please check back here for the most updated information on trended credit reports in the mortgage industry and how Advantage Credit is supporting its customers through this transition.

Customer Testimonials

“Because Universal Lending has been in business for 30 years we have utilized many different credit reporting agencies. Advantage Credit compares to no other. Their prompt, accurate and reliable credit …

Read Testimonials