In September, Fannie Mae announced that on November 17, 2025 they would start adding Vantage 4.0 to their disclosures. This announcement was made in preparation for their ability to accept the Vantage 4.0 score. The systems must be integrated first, which they are currently working on. With this announcement though, comes a great deal of questions.

How will this process operate? Currently, the GSEs have not yet updated their servicing or selling guidelines. However, it is known that they will begin accepting either the Classic FICO score or the Vantage Score. They will not accept both models for a single loan, and scores cannot be combined or “mixed and matched.” Additional guidance from the GSEs will be provided in the near future. Loan originators may pull both scores and determine which model is most appropriate for their borrower.

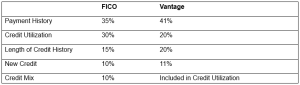

There are some significant differences between FICO and Vantage 4.0. One being how they weigh certain attributes:

Another notable difference is that Vantage 4.0 factors Trended Data. While Trended Data is available with FICO scores, it is not factored into the models. FICO scores are a “snapshot” of a moment in time. Trended Data looks at the data over a period of time, going back 24 months and analyzes trends that transpire on any give account.

For example, if a borrower’s revolving balances increase steadily month over month, even when payments are made on time, this may indicate a higher level of risk. Conversely, a consistent decline in balances or paying off accounts each month could suggest a lower credit risk. Additionally, patterns such as missed payments or frequent opening of new accounts can be indicative of potential risk. Essentially, this involves reviewing the historical account activity. There is no fixed percentage assigned to this factor; rather, it is integrated into the overall assessment alongside other considerations.

Other noteworthy differences would be:

- To generate a score for Vantage, a consumer only needs one month of credit history whereas for a FICO score a consumer must have at least six months of history on an account.

- Vantage Scores ignore all paid collections (not just medical) FICO removes all paid medical collections, but non-medical are factored into the scores.

- Vantage Scores ignore all unpaid medical collections. FICO ignores all unpaid medical collections under $500.

- Vantage Scores will factor in alternative credit such as rent and utilities. FICO Classic Scores do not.

Because of some of its unique attributes, and the fact that Vantage scores can be a bit more forgiving than FICO scores, the hope is that Vantage 4.0 will expand access to homeownership to potential borrowers that have been underserved in the past. While Classic FICO remains available, offering the additional option of Vantage 4.0 will broaden opportunities for many individuals to achieve homeownership.